Limited stock. No rainchecks. All Robots New and available for immediate delivery.

Grab a bargin now.

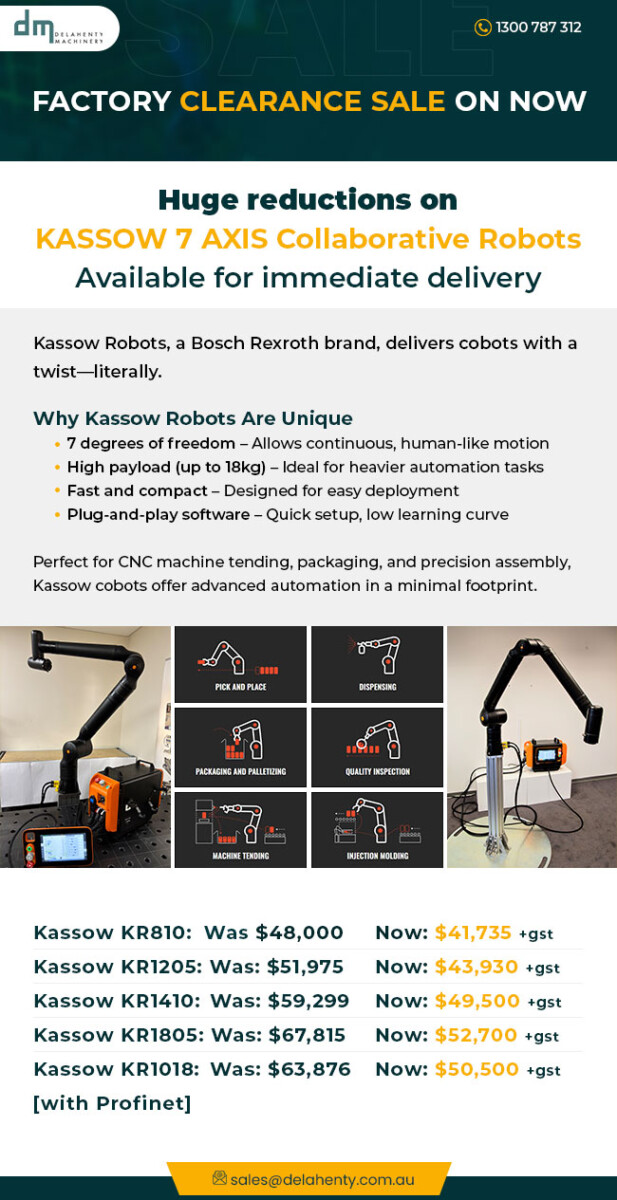

- Kassow Robots, a Bosch Rexroth brand, delivers cobots with a twist- literally.

- Their 7-axis arms bring unmatched agility and reach, especially in tight spaces.

Why Kassow Robots Are Unique

7 degrees of freedom – Allows continuous, human-like motion

High payload (up to 18kg) – Ideal for heavier automation tasks

Fast and compact – Designed for easy deployment

Plug-and-play software – Quick setup, low learning curve

Perfect for CNC machine tending, packaging, and precision assembly, Kassow cobots offer advanced automation in a minimal footprint.

Kassow KR810: Was: $ 48,000 Now: $ 26,587+gst

Kassow KR1205: Was: $ 51,975 Now: $ 28,780 +gst

Kassow KR1410: Was: $ 59,299 Now: $ 34,262 +gst

Kassow KR1805: Was: $ 67,815 Now: $ 37,552 +gst

Kassow KR1018*: Was: $ 63,876 Now: $ 35,266 +gst

[*with Profinet communications]

![MACKMA - BM48 - Rotary Draw Bending Machine [NOW $19,500+GST] MACKMA - BM48 - Rotary Draw Bending Machine [NOW $19,500+GST]](https://www.delahenty.com.au/newwp/wp-content/uploads/2021/07/5875294.o.jpg)